Content

Another avenue to consider is working with a financial professional who can help review your records and put the right practices in place to ensure efficiency. The team at Franco Blueprint is ready to help you with a variety of processes, like setting up your business, managing and preparing your taxes, and automating processes like accounting. If costs and expenses are higher than your total revenue, then you need to figure out a way to decrease these costs as they are not contributing to your revenue in a positive https://online-accounting.net/ manner. The movement in all the line items of an income statement indicates to relevant stakeholders how the company is performing and whether it is moving towards profitability or not. The net profit ratio or the net profit margin ratio is important for investors to see whether the company is generating enough profits to cover all its costs. When you divide the current assets by the current liabilities you get the current ratio. This ratio measures the ability of an organization to pay its short-term obligations.

The difference between expenses and sales is usually negative for some period of time. The negative amounts should be accumulated to give you an idea of how much you will need to borrow to get your business started. Don't forget to add cash transactions, both income and expenses.

Calculate Direct Costs

While the definition of an income statement may remind you of a balance sheet, the two documents are designed for different uses. Income Statement vs. P&L An income statement tallies income and expenses; a balance sheet, on the other hand, records assets, liabilities, and equity.

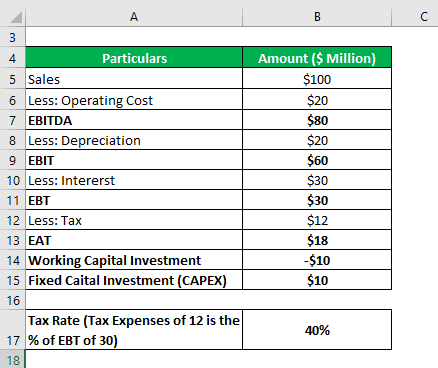

It’s frequently used in absolute comparisons, but can be used as percentages, too. This then gives a balance which represents the net profit or loss for the year. A profit and loss (P&L) statement summarizes the revenues, costs and expenses incurred during a specific period of time. The balance sheet and the profit and loss (P&L) statement are two of the three financial statements companies issue regularly.

Comments for Income Statement vsProfit and Loss Account

Though both of these are a little oversimplified, this is often how the P&L statement and the balance sheet tend to be interpreted by investors and lenders. Our expert bookkeepers here at Bench have built a profit and loss statement template in Excel. You can use it to turn your business’ financial information into a P&L statement. We’ve created a profit and loss statement for an imaginary small business—Terracotta Warriors, a supplies store for potted plant enthusiasts.

What are the three 3 types of income statement?

- Single-Step Income Statement.

- Multi-Step Income Statement.

- Generate Your Income Statement Using Deskera Books.

Once you subtract all these different indirect costs from the gross profit or loss, the amount you will end up with is your company’s operating profit or loss. The profit and loss statement is important because it shows the revenue, expenses, and if the company has made a profit or loss.

Shareholder Equity

Download our free Excel-based profit and loss statement template to create your first P&L report today. While you may be comfortable using Excel to prepare P&L statements, automating these reports with an FP&A platform is faster. It also improves accuracy since manual entry often leads to errors. You can feed data directly from your centralized database, and the software produces the income statement automatically, leaving you with more time to drill down and surface new insights. Revenue - Cash inflows or other enhancements of assets of an entity during a period from delivering or producing goods, rendering services, or other activities that constitute the entity's ongoing major operations.

Why is an income statement considered a profit & Loss statement?

A profit and loss statement is a financial report that shows how much your business has spent and earned over a specified time. It also shows whether you've made a profit or a loss over that time – hence the name. A profit and loss statement might also be called a P&L or an income statement.